Excellent Guidance To Help You With Home Mortgages

Written by-Hart HoffmanTo a person untrained in the art of real estate, the mortgage financing process can seem incredibly complicated. Although mortgages are difficult to fully understand, by educating yourself on the best mortgage practices you can learn everything you need to know to get a good deal on your mortgage. This article is filled with great mortgage information, so read on to learn more.

If you are considering quitting your job or accepting employment with a different company, delay the change until after the mortgage process has closed. Your mortgage loan has been approved based on the information originally submitted in your application. Any alteration can force a delay in closing or may even force your lender to overturn the decision to approve your loan.

Have at least 20 percent of the purchase price saved. Lenders will want to verify that you have not borrowed the money, so it is important that you save the money and show deposits into your checking or savings account. Down payments cannot be borrowed; thus it is important to show a paper trail of deposits.

Think about getting a consultant hired if you wish to get help with your home mortgage. There is much to learn in this process, and they can help you obtain the best deal you can. They can also make sure your have fair terms instead of ones just chosen by the company.

Even if you are underwater with your mortgage, the new HARP regulations can help you get a new loan. In the past it was next to impossible to refinance, but this program makes it much easier to do so. Check it out to see how you might benefit from it, which can include lower mortgage payments as well as optimal credit positioning.

Pay down your debt. You should minimize all other debts when you are pursuing financing on a home. Keep your credit in check, and pay off any credit cards you carry. This will help you to obtain financing more easily. The less debt you have, the more you will have to pay toward your mortgage.

Understand how interest rates will affect you. The interest rate will have an impact on how much you pay. Learn how the rates will effect the monthly payments as well as the overall increase in the amount that you have borrowed. If you don't pay attention to them, you might have a higher monthly payment than you intended to have.

When rates are near the the bottom, you should consider buying a home. If https://www.forbes.com/advisor/banking/tips-for-military-families-reduce-financial-stress/ do not think that you will qualify for a mortgage, you should at least try. Having your own home is one of the best investments that you can make. Quit throwing away money into rent and try to get a mortgage and own your own home.

Save up for the costs of closing. Though you should already be saving for your down payment, you should also save to pay the closing costs. They are the costs associated with the paperwork transactions, and the actual transfer of the home to you. If you do not save, you may find yourself faced with thousands of dollars due.

If you are having difficulty paying a mortgage, seek out help. Look into counseling if you are having trouble keeping up with your payments. There are government programs in the US designed to help troubled borrowers through HUD. These counselors offer free advice to help you prevent a foreclosure. Call or visit HUD's website for a location near you.

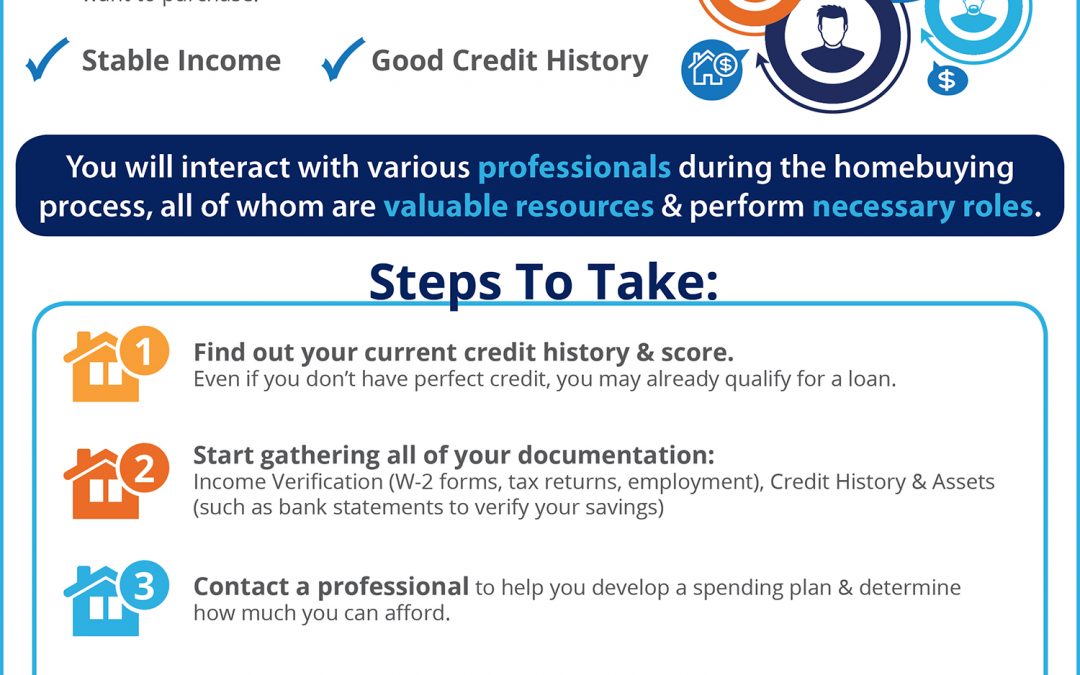

You should have the proper paperwork ready in advance for a lender. Look well prepared. You'll need a copy of your pay stubs going back at least two paychecks, your last year's W-2 forms and a copy of last year's tax return. You'll also need your bank statements. Get those together before the lender asks.

Be careful when taking out a second line of financing. Many financial institutions will allow you to borrow money on your home equity to pay off other debts. Remember you are not actually paying off those debts, but transferring them to your house. Check to make sure your new home loan is not at a higher interest rate than the original debts.

Before you begin home mortgage shopping, be prepared. Get all of your debts paid down and set some savings aside. You may benefit by seeking out credit at a lower interest rate to consolidate smaller debts. Having your financial house in order will give you some leverage to get the best rates and terms.

Ask your lender in advance what documentation they need before you meet with them. This is usually going to include tax returns, income statements and W2s, although more might be needed. The more time you have to get it all together is the less likely you'll be unprepared at the actual meeting time.

Don't use real estate brokers or mortgage lenders who encourage you to lie on your home mortgage application. It is illegal to lie on this application, and it is a legal document. Misrepresenting your income or other information is grounds for criminal prosecution. Working with people who encourage you do commit a crime is not a good idea.

Pay your mortgage down faster to free up money for the future. Pay https://thefinancialbrand.com/125716/what-relationship-banking-should-look-like-in-2022-fintech-partner/ when you have some extra savings. When you pay the extra each month, make sure to let the bank know the over-payment is for the principal. You do not want them to put it towards the interest.

Get the best rate with the lender you have now by being aware of rates offered by others. There are a lot of financial institutions, both online and in the real world, that offer very good interest rates. You can use this information to motivate your financial planner to come up with more attractive offers.

Do not forget to consider the local property tax rates before you enter into a home mortgage contract. Just because you can afford the mortgage payment does not mean that you will be able to afford the taxes on the home. In some areas the taxes on a modest home can feel like a second mortgage, so be sure to look into this.

Knowledge is empowering. Rather than moving forward with uncertainty, you really can proceed with solid know-how. Before entering into an agreement, carefully go over each of your options.